Denver investors' favorite 2016 investments

They love stocks, not so crazy about annuities

Stephen Stribling //October 8, 2015//

Denver investors' favorite 2016 investments

They love stocks, not so crazy about annuities

Stephen Stribling //October 8, 2015//

Denver high net worth (HNW) investors are anticipating stocks or equities (46 percent) as the top asset allocation preference in 2016, followed by cash (21 percent) and fixed-income investments (20 percent).

The findings are from the latest Morgan Stanley Investor Pulse Poll that surveyed 1,003 HNW investors across the United States, including 300 from the Denver Metro Market. Individuals who are considered HNW investors have $100,000 or more in investable household financial assets, excluding real estate holdings and retirement accounts.

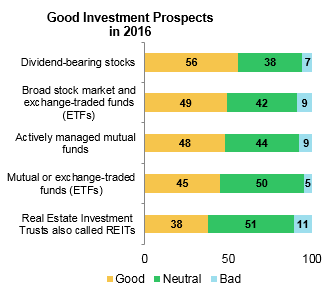

Reflecting allocation priority toward stocks and equities, dividend-bearing stocks (56 percent), broad stock market and exchange-traded funds (ETFs) (49 percent), and actively managed mutual funds (48 percent) are the only financial products seen by a majority or near-majority of Denver-area HNW investors to be “good” investments. Though rated as “good” by fewer than half of HNW investors, mutual or exchange-traded funds (45 percent) and Real Estate Trusts (REITs) (38 percent) round out the top-five favored investments.

Reflecting allocation priority toward stocks and equities, dividend-bearing stocks (56 percent), broad stock market and exchange-traded funds (ETFs) (49 percent), and actively managed mutual funds (48 percent) are the only financial products seen by a majority or near-majority of Denver-area HNW investors to be “good” investments. Though rated as “good” by fewer than half of HNW investors, mutual or exchange-traded funds (45 percent) and Real Estate Trusts (REITs) (38 percent) round out the top-five favored investments.

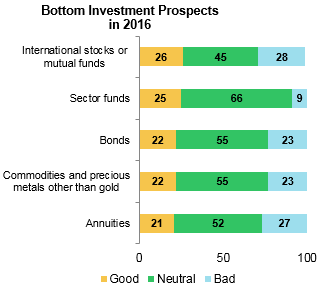

In most cases, investments are rated by nearly half or more as “neutral.” Roughly one in four or more HNW investors view international stocks or mutual funds (28 percent), annuities (27 percent), gold (27 percent), commodities and other precious metals (23 percent), and bonds (23 percent) are seen as “bad” investments for 2016.

Keep in mind that it is likely you'll have to make periodic adjustments from to your portfolio. Make sure the investments you've chosen are still an accurate reflection of your risk tolerance and time horizon.

Read more about what Denver investors are thinking: Denver investors: U.S. is best and Denver investors: Interest rates are going up.