New energy players are invigorating real estate markets

JLL's annual Energy Outlook finds renewable growth is fueling demand

ColoradoBiz Staff //November 2, 2016//

New energy players are invigorating real estate markets

JLL's annual Energy Outlook finds renewable growth is fueling demand

ColoradoBiz Staff //November 2, 2016//

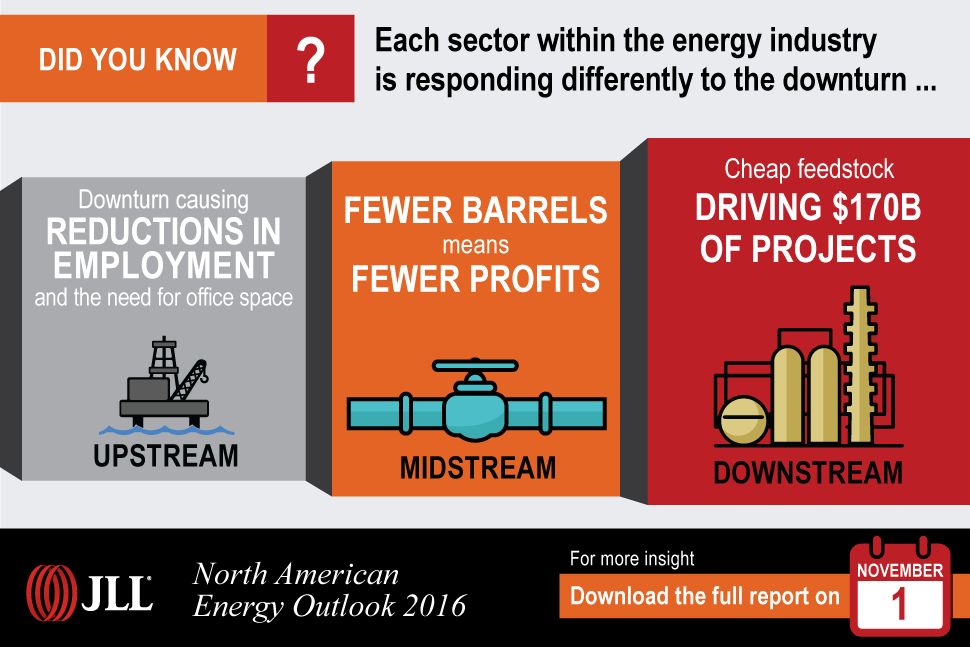

With oil prices fluctuating, the North American energy industry is undergoing a major shift, forcing oil and gas companies to face tighter budgets and rethink office space for a modern workforce. According to JLL’s annual 2016 North American Energy Outlook, upstream and midstream oil and gas companies and the companies that serve them are at a critical juncture to move toward a slimmer, more flexible real estate portfolio.

At the same time, the growing downstream industry is creating new demand for industrial real estate in places like western Pennsylvania, eastern Texas and the Gulf Coast. Meanwhile, the continued expansion of solar and wind energy production is creating new alternative energy clusters in Denver and California.

“A newer, leaner oil and gas industry will emerge from the downturn, and it’s only natural that real estate strategies will follow,” said Bruce Rutherford, Co-Lead of JLL’s Energy group. “This is a watershed moment for traditional oil and gas companies to rethink their real estate. Today’s market conditions are providing opportunities for companies to move toward more efficient space layouts and negotiate more flexible lease terms.”

Turbulent oil prices spur new real estate strategies

The downsizing of white-collar positions and therefore, office space in oil and gas firms, has caused an unprecedented flood of both sublease and direct space on to the market, especially in energy-heavy locations like Houston and Calgary. The availability of sublease space exploded to 22.6 million square feet in the top seven North American energy cities in the second quarter of 2016.

For markets heavily impacted by the downturn, reversing the trend will potentially take years. For this to occur, crude oil prices will need to stabilize, energy companies will then expand capital budgets, grow headcount and work through excess office space before returning to expansion mode.

Bright Spot: Booming downstream sector

The downstream sector has been in growth mode during the past several years, as the shale boom and decline in oil prices have fueled a revolution in the petrochemical industry. As cheaper energy inputs allow for the increased manufacturing of intermediate chemicals and finished plastic products, the sector is currently constructing or planning 268 projects across the U.S., costing approximately $170 billion, according to the American Chemistry Council.

Along the Gulf Coast and in western Pennsylvania, the level of capital flowing into the downstream sector is spurring demand for specialized industrial projects and increasing demand for neighboring manufacturing and warehouse space. This demand for real estate coupled with a disposable income windfall for households due to lower gasoline, natural gas, and energy costs, is also spilling into the retail and multifamily markets.

Bright Spot: Renewable energy revolution

Though still a smaller proportion of total energy production, renewable energy supply in the U.S. has spiked by 51.4 percent since 2006, according to the Energy Information Administration. The growth of wind and solar power is pushing demand for both office and industrial real estate from equipment manufacturers.

“We expect further expansion of renewables and the clean tech industry as new legislation and the increasing cost-competitiveness of wind and solar incite further development,” said Eli Gilbert, Vice President of Research at JLL and leader of the energy research group. “A diverse array of commercial real estate markets in North America will reap the benefits from this growing sector.”

Denver, for example is growing into a renewable cluster with clean tech companies flourishing in the region. In fact, Colorado, specifically the Denver/Fort Collins market, has the highest concentration of wind manufacturing jobs in North America.

“Similarly, California and Arizona are emerging as top markets for solar energy,” Gilbert said. “With the highest concentration of solar company headquarters in the continent, California may become the next renewable energy hub.”

About the Report

JLL’s annual Energy Outlook provides in-depth and actionable content sourced from JLL’s deep bench of research and brokerage professionals. This year’s Energy Outlook analyzes macroeconomic trends influencing energy markets, the state of oil and gas companies, impact to subsectors, regulation and legislation, and trends in renewable energy. The complete findings of the Energy Outlook are available in a dedicated microsite.

About JLL

JLL (NYSE: JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. JLL is a Fortune 500 company with, as of December 31, 2015, revenue of $6.0 billion and fee revenue of $5.2 billion, more than 280 corporate offices, operations in over 80 countries and a global workforce of more than 60,000. On behalf of its clients, the company provides management and real estate outsourcing services for a property portfolio of 4.0 billion square feet, or 372 million square meters, and completed $138 billion in sales, acquisitions and finance transactions in 2015. As of September 30, 2016, its investment management business, LaSalle Investment Management, has $59.7 billion of real estate assets under management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit www.jll.com.