GDP Grows – Is Now the Time to Buy Real Estate?

Does the GDP growth paint the full picture?

Glen Weinberg //July 31, 2018//

GDP Grows – Is Now the Time to Buy Real Estate?

Does the GDP growth paint the full picture?

Glen Weinberg //July 31, 2018//

The Commerce Department reported that gross domestic product surged to 4.1 percent this past quarter from 2 percent the prior quarter. Is this the dawning of a new era of increased economic prosperity? Should you buy real estate now with expected future increases in the economy? What is driving this uptick in GDP?

- GOVERNMENT SPENDING

One of the largest drivers of the increase in GDP is government spending at the state and local levels. As the economy has improved, more money has flown into state coffers. According to the census bureau: “ The acceleration in real GDP growth in the second quarter reflected accelerations in federal government spending and in state and local spending.”

- DECREASE IN SAVINGS

Along with increased government spending, consumers are also spending more, fueled by a decrease in savings. Real wages have not increased substantially, so the only way for people to spend more is to save less or borrower more. The recent GDP report highlights that, “Personal saving was $1.05 billion in the second quarter, compared with $1.09 billion in the first quarter. The personal saving rate –as a percentage of disposable personal income – was 6.8 percent in the second quarter, compared with 7.2 percent in the first quarter.”

To drive recent spending growth, consumers are saving less and, therefore, have less of a cushion for future needs.

- INCREASED DEBT

Consumers are also spending more by increasing the amount of debt they have. The Federal Reserve’s latest Quarterly Report on Household Debt and Credit reveals total household debt reached a new peak in the first quarter of 2018, rising $63 billion to reach $13.21 trillion. Balances climbed 0.6 percent on mortgages, 0.7 percent on auto loans and 2.1 percent on student loans this past quarter. Unfortunately, a debt-fueled spending binge can’t last forever and at some point, the consumer will have to “pay up” on their debt binge.

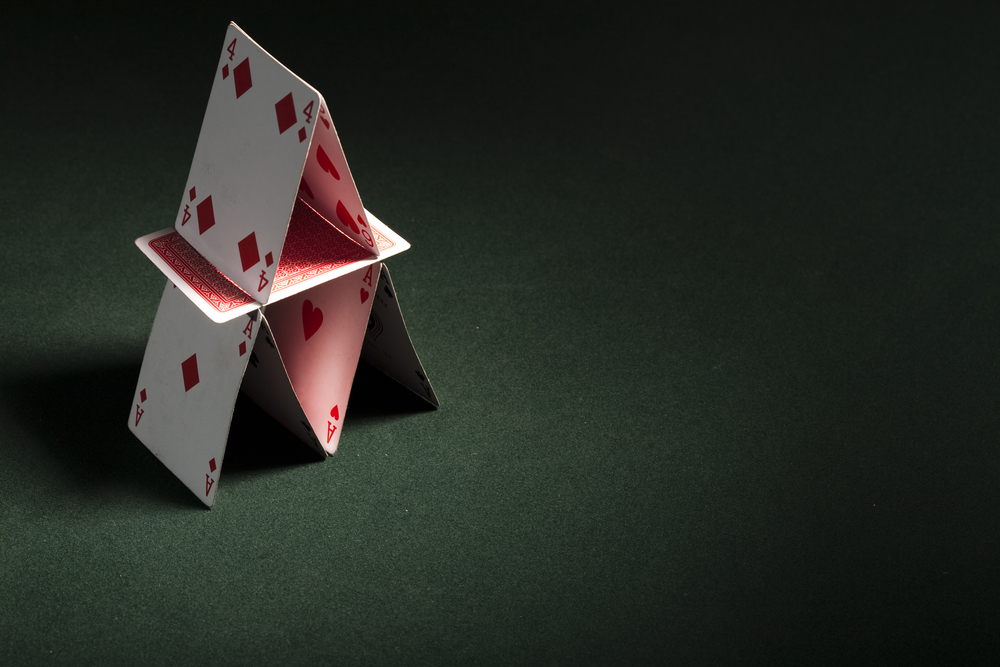

None of the three drivers above are sustainable for GDP growth. They are merely byproducts of the expansion that the economy is currently in. Business spending, innovation and efficiency, as well as long-term wage growth are the only factors that can maintain economic growth. Furthermore, the impressive GDP numbers are concealing other long-term metrics, painting a radically different picture of the economy.

GDP NUMBER NOT PAINTING THE FULL PICTURE

- CONSUMER SENTIMENT

Consumers are the largest driver of the U.S. economy. If the economy is performing well, why did U.S. consumer sentiment dip to a six-month low in July, according to a University of Michigan survey? This survey of consumers is clearly pointing to a very different long-term future of the economy.

- BUSINESS SENTIMENT

According to a recent Empire Survey of business performed by the Federal Reserve of New York planned capital expenditures and technology spending fell to its lowest levels in 11 months. The Philadelphia Fed survey had similar results with the outlook for “business activity” falling to its lowest level since 2016.Business sentiment is clearly not in sync with the robust GDP numbers.

Housing is one of the key indicators of long-term economic prosperity. As consumers become more confident in the economy, they are more likely to buy or build a house and make other long-term commitments. Housing is also telling a very different story than the GDP numbers. In June, residential housing starts fell 12.3 percent, multifamily fell 19.8 percent and permits (a proxy for future builds) fell 2.2 percent. Furthermore, a recent builder survey found that sales were “sluggish” in June.

GDP and the market are looking at the economy very differently. Consumers, businesses and the housing market are all flashing warning signals of future turbulence ahead. This turmoil could flow through all sectors of the economy, including real estate. The recent GDP number is not sustainable based on current indicators. Regardless of the euphoria surrounding U.S. GDP, now is the time to be cautious as the “sugar high” from will, inevitably, fade.