Do inflation-hedged investments deliver?

James Osborne //October 16, 2013//

Inflation-hedged investments are all the rage. Since the commodities boom of the mid 2000′s and politically-driven town criers screaming of Fed-induced hyperinflation, investors and their advisors have scrambled to build portfolios with an eye on “inflation hedged” investments.

This has meant a scramble for commodity investments and Treasury Inflation-Protected Securities, among others, in hopes of keeping inflation at bay. Conveniently, these investments have also been sold as “portfolio diversifiers,” promising to help reduce overall portfolio risk.

In practice, there are a few problems here. The first is that as access to an asset class changes, its behavior changes as well. Most studies demonstrating the value of commodities as part of a diversified portfolio will rightly include the last 40 or more years, a period that includes the inflation-ridden 1970s where commodity prices boomed and stock markets lagged.

Of course, investing was a bit different in the 1970s. You couldn’t exactly walk down to the corner eTrade office and buy a few hundred shares of an ETF to gain exposure to the price of oil or gold or soybeans. As access became readily available, commodity price behavior began to change.

What was once an asset class that may have “zigged” when markets “zagged” is now more likely to move in tandem with markets, because both stocks and commodities are owned by the same poorly behaved investors given to greedily buy and fearfully sell. This is known as the “diversification paradox” as low-correlating (good diversifying) trades get “crowded” as everyone wants to own them.

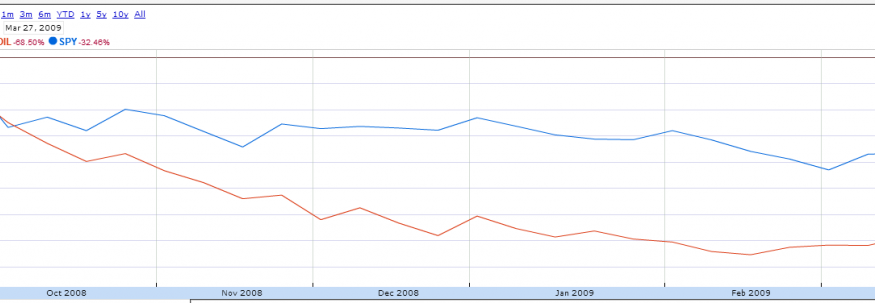

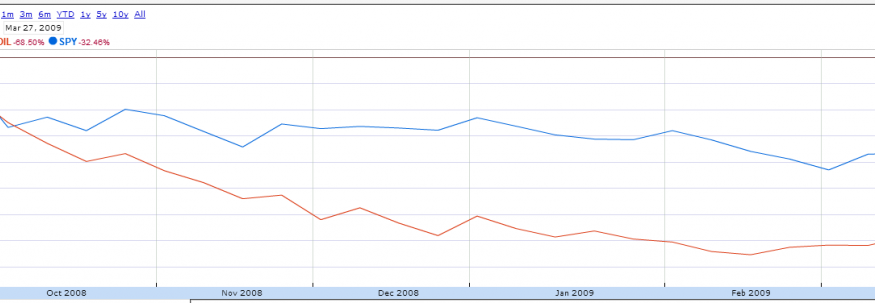

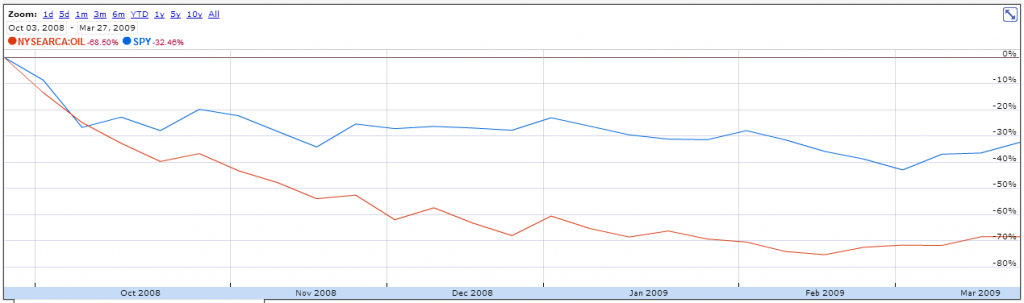

As an example, let’s look at how oil prices ($OIL) and large cap US stocks ($SPY) behaved from the failure of Lehman Brothers to the stock market bottom (9/08-3/09):

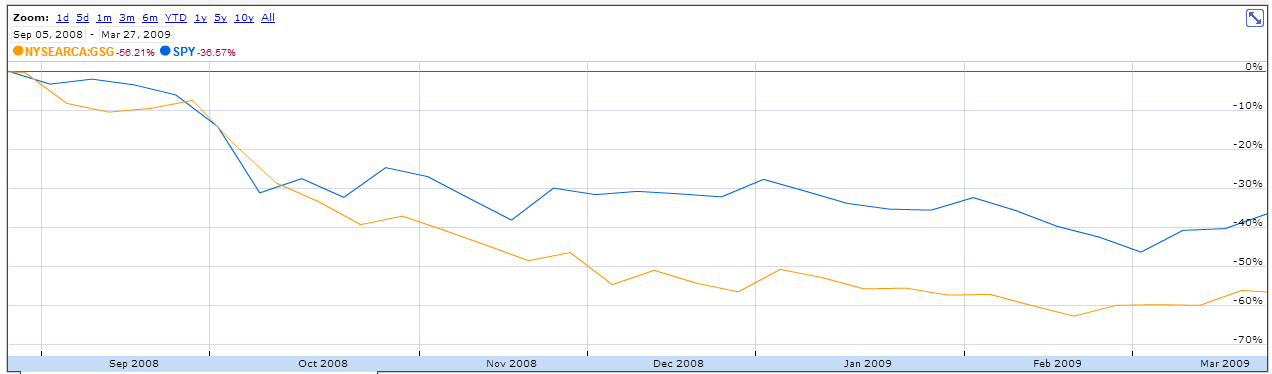

And just for good measure, here’s a broad basket of commodities against large cap stocks ($SPY) did over the same period:

Of course, this is just one time period, but we must question if commodities as diversifiers have lost some of their sparkle.

The second issue has less to do with the alleged diversification benefit and more to do with whether or not these investments are actually hedging inflation. In narrative, it makes perfect sense that commodities and TIPS would provide excellent inflation protection. TIPS have mandated, built-in inflation adjustments and commodities are physical assets priced in US dollars that should logically maintain real value in an inflationary period.

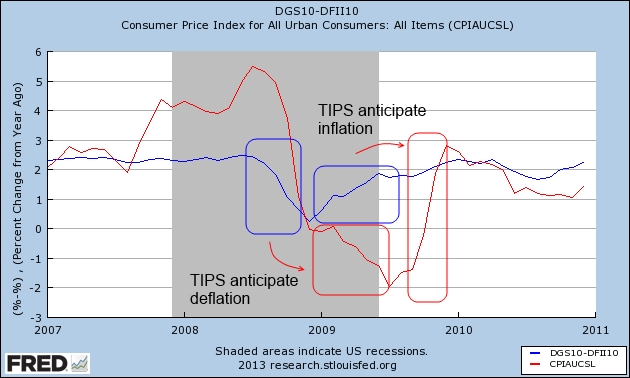

What we have to realize is that markets are discounting mechanisms. In the short run, markets are machines of expectations, not reality. Investment hedged against inflation will move with the expectation of inflation, not inflation itself. At times this means the investment market will move ahead of actual changes in inflation, as we can see below with the implied inflation rate in TIPS compared with US CPI:

Busy, but you can see that TIPS-implied inflation is moving ahead of actual CPI.

What happens when expectations don’t become reality? 2013 has been a good example as TIPS are off almost -6.5 percent through 10/7/13, falling much father than the broad bond market’s -1.88 percent drop over the same time. Investors bought up the price of TIPS in anticipation of inflation that never came.

The truth is that as a trade becomes crowded, when once-heralded strategies become commonplace for many investors, the strategy can lose its value. Investors hoping to own inflation-protecting investments must do so not only before actual inflation rears its head, but before the expectation of inflation is widely held. Otherwise the expectation of inflation is already priced in to the investment, leaving little to be had for the latecomer. Of course this discussion does not begin to shine a light on many of the other problems faced by investors hoping to add commodities to their portfolios, which I have already addressed.

I am a huge believer in academically robust investment strategies. Investors need data and not narratives to make big picture investment decisions. However there are times when what is true in theory is difficult to replicate in practice. Thankfully for investors, there is a readily available, easily accessible asset class that delivers healthy inflation-adjusted returns: stocks.