The new health care exchanges:

Patricia Dean //September 16, 2013//

With only three weeks remaining before the health exchanges open for business, the biggest challenge to President Obama’s signature health care legislation is an open question. As politicians in Washington D. C. debate refusing to raise the debt limit unless “Obamacare” is defunded, some are predicting a train wreck, while others say all the dire predictions are much ado about nothing.

While there will no doubt be glitches and failures, the truth seems to depend on where you live. And, once again, it is an advantage to live in Colorado.

Colorado’s Health Care Marketplace – Connect for Health Colorado

Colorado is one of only 16 states and the District of Columbia that set up its own new health insurance marketplace, called Connect for Colorado Health. Starting Oct. 1, it will be responsible for signing up Colorado and seeking to purchase coverage in the individual and small-group markets.

Currently, there are approximately 2.25 million Coloradoans with health insurance. That number is expected to increase by roughly 500,000 under the ACA, with the majority of those likely purchasing policies through Colorado’s Exchange. In addition, Connect for Colorado Health will be responsible for determining whether those who contact the Exchange are eligible for Medicaid under the ACA’s Medicaid expansion and whether consumers are eligible for subsidies to reduce the cost of their health insurance. This “one stop shopping” will be the first time state agencies have integrated private and government-sponsored insurance under one roof.

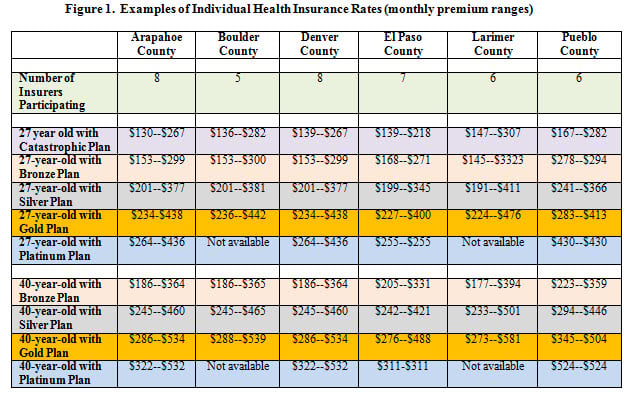

Last month, the Colorado Division of Insurance approved 541 separate plans offered by 18 different insurers on a statewide basis. Prices vary by the county in which the consumer lives and the level of coverage chosen. (In 2015, insurers will also be permitted to charge different rates for smokers.)

The levels of coverage are broken down into four categories: Platinum, which covers 90 percent of medical costs; Gold, which covers 80 percent; Silver, which covers 70 percent; and Bronze, which covers 60 percent. The individual market has one additional tier, a “catastrophic plan” which provides bare-bones coverage for those under age 30 (or older than 30 if the individual meets specific financial eligibility requirements).

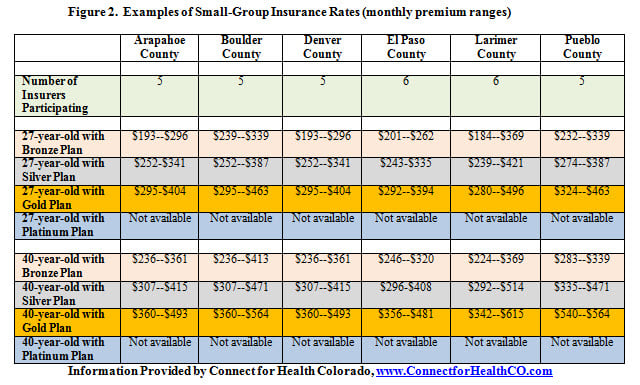

Within each level of coverage, consumers can shop between competing insurers, although all plans are required to cover a set of minimum services, called “essential health benefits.” Figure 1 provides a sampling of monthly plan premiums for individuals around the state. The state Exchanges will also sell policies to small groups, which are defined as having less than 50 employees. A sampling of the small-group policies by select counties appears in Figure 2.

The successful implementation of Colorado’s exchange is due in large part to the State’s early and unified approach. Colorado set up its Exchange with the passage of a bipartisan bill in 2011. Republicans agreed to back the bill if it included a legislative oversight committee that could block future exchange funding. While many legislators were skeptical and there has been much debate over the last two years, the oversight committee has not denied any funding requests. Indeed, at its final meeting before the exchanges go online October 1, members of both parties praised the Exchange’s leadership for creating a dynamic marketplace for health insurance. The Colorado Exchange opened its call center a little over a week ago, although it will not be able to help consumers purchase insurance until Oct. 1.

By its official opening date, there will be 187 customer service agents available to guide customers through the process of purchasing insurance. These so-called “navigators” will be able to enroll eligible Coloradoans in Medicaid and to calculate subsidies for those eligible. There will be a group of navigators dedicated to Spanish-speakers and the Exchange has outside access to experts who can assist customers in 173 different languages.

{pagebreak}

Colorado’s Concerns

Despite its successful creation, Connect for Health Colorado recognizes that the glitches are inevitable. The largest identified to date resulted in a recent “red light warning” signaling a potential problem with data sharing between the Exchange and Colorado’s Medicaid system.

While Colorado’s Exchange leadership and managers from exchanges throughout the country are pressing the federal government for a workable solution, there are reports that the Social Security Administration data system will be off-line four hours every night, causing enormous slowdowns. However, Connect for Health Colorado indicated it will employ a contingency plan as a temporary solution if needed.

The other significant issue identified concerns the availability of premium subsidies for family coverage for employees of small businesses. According to ACA regulations, employees covered by small-group employers can opt out of employer-sponsored coverage and have the potential to receive federal subsidies to purchase insurance through the exchange if their employers’ plans are deemed unaffordable (meaning that the plans costs more than 9.5 percent of their employees’ income).

This rule, however, is based on the cost of an individual health plan. If the employee is offered both an individual plan and a family plan through his/her employer that costs in excess of 9.5 percent of his/her income, the employee’s family is ineligible to receive premium subsidies in the Exchange. Members of the oversight committee from both parties have criticized the effect of this rule on vulnerable populations.

Other States

While all states are preparing for glitches, not all states are expected to fare as well as Colorado. Almost half of the states rejected the Medicaid expansion. As a result, an estimated 5 million of the nation’s poorest individuals will not be able to get coverage in 2014. Similarly, 34 states elected not to set up their own marketplace, opting instead to have the federal government run their exchanges.

While federal employees will operate exchanges in these states, the federal government is stretched thin and problems for consumers and insurers alike are anticipated. Some of these states have been working with the federal government to make sure health plans meet the new standards and will assist with customer service.

Other states, such as Alabama, Oklahoma, Texas, Wyoming and Florida, however, had explicitly decided that their respective insurance commissioners will not review health plans to ensure consumers are protected. For example, in Missouri, a 2012 initiative passed by voters specifically prohibits state workers from providing any assistance to its health insurance exchange. And, in Florida, the legislature and governor stripped the insurance commissioner of his authority to block rate hikes for the next two years. Since this power rests with the states, insurance companies will be permitted to raise some premiums as much as they choose in 2014 and 2015.

Conclusion

As is the case with almost every aspect of Obamacare, rancorous debate surrounds how effective the state exchanges will be controlling costs and providing consumers with a transparent marketplace to shop for individual and small-group insurance. While there will be winners, losers and wide-spread glitches, its apparent that Coloradoans have a bit of an advantage.