The SaaS churn effect

Dan King //April 7, 2014//

The subscription-based economy is coming, if not here already. Software providers are especially focusing sales efforts away from the “transaction” model, to longer term focused “customer relationship” models. The best example of this concept today is a Software-as-a-Service (SaaS) business.

The SaaS financial community developed sophisticated metrics to measure pertinent activities that help the business grow, or, prevent its demise. These metrics are not measured through traditional Generally Accepted Accounting Principles (GAAP). Rather, these Non-GAAP measures monitor the financial health of the business with three topics in mind: 1) customer acquisition, 2) customer monetization; and 3) customer retention.

Typical metrics include:

- CMRR (Committed Monthly Recurring Revenue),

- CAC (Customer Acquisition Costs, including CAC payback periods),

- CLTV (Customer Lifetime Value),

- Cash Flow, and

- Churn (the primary focus on this article)

Arguably, the most important metric to measure a subscription based businesses growth or decline is through its churn rate. Churn simply means the rate (measured in percentages, dollars or both) upon which a customer elects to upgrade, downgrade or leave a subscription service offering altogether.

Churn rates should be measured as a positive number. A positive churn rate means a company is losing business from its existing customer base which hinders growth. This type of churn is can be associated with customers electing to leave software vendor entirely, usually through death (customer goes away) or marriage (customer gets acquired).

Churn can also be measured as a negative number. A negative churn rate means a company is acquiring incremental business from its existing customer base contributing to its overall growth. This type of churn is desirable and often associated with customers increasing their level of software and services usage. Similar terminology used includes customer “upgrades”, or a “land and expand” strategy.

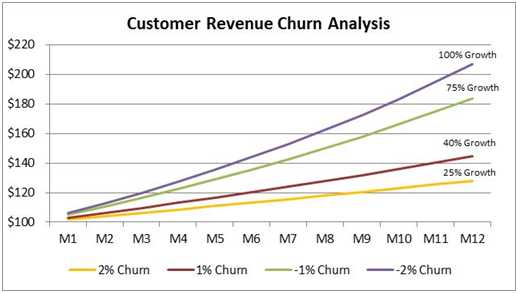

Revenue impacts of churn are measurable and very impactful. Let’s analyze four examples for SaaS Co, Inc., All four examples start with an assumed 50 percent new customer annual revenue growth (before churn), with $100 in combined revenue from its existing customer base at the beginning of the year (Month 1). Specifics as follows:

- Example 1 – 50 percent annual revenue growth, 2 percent monthly positive revenue churn

- Example 2 – 50 percent annual revenue growth, 1 percent monthly positive revenue churn

- Example 3 – 50 percent annual revenue growth, 1 percent monthly negative revenue churn

- Example 4 – 50 percent annual revenue growth, 2 percent monthly negative revenue churn

Again, SaaS Co, Inc. grew 50 percent, before measuring churn impacts. By applying the four examples above you can visually see the revenue outcomes by the end of month 12 as follows:

The revenue from churn impacts are:

Example 1 – +2 percent Churn – Revenue grows only ~25 percent. The positive 2 percent churn rate brings growth levels down from the 50 percent annual revenue expected. This is because the company is gaining customer revenue, but also losing revenue through churn.

Example 2 – +1 percent Churn – Revenue grows only ~40 percent. The positive 1 percent churn rate also brings the average growth levels down from the 50 percent annual revenue expected. This is because the company is gaining customer revenue, but also losing revenue through churn, although at a lower churn rate that the example 1 above.

Example 3 – -1 percent Churn – Revenue grows ~75 percent. The negative 1 percent churn rate contributes incrementally higher growth levels from the 50 percent annual revenue expected. This is due to the compounding effect of adding revenue from new customers, and incrementally adding more revenue from the existing customer base. And last:

Example 4 – -2 percent Churn – Revenue grows ~100 percent. The negative 2 percent churn rate contributes even more incrementally higher growth levels from the 50 percent annual revenue expected, again, from the compounding effect from the existing customer base noted in example 3.

Now we better understand the colossal impact churn has on a subscription business. New customer growth and negative churn rates provide a fantastic way to measure the underlying financial trajectory. Lean on your CFO or Finance team to help measure and monitor this activity. Activities like churn management demonstrate your company’s desire to “play to win”, as opposed to “playing not to lose”.