The role of trusts in estate planning

The differences between a will and a trust

Shelley Thompson //January 22, 2020//

The role of trusts in estate planning

The differences between a will and a trust

Shelley Thompson //January 22, 2020//

As much as we might not like thinking about our passing, it is beneficial to organize your assets before you pass. Creating an estate plan can give you peace of mind knowing that your assets will be distributed appropriately to your loved ones.

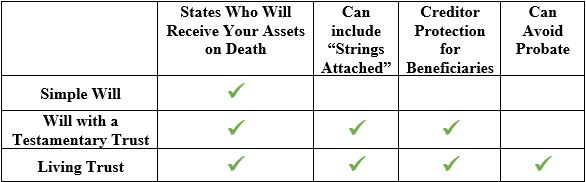

When you create an estate plan, there are many considerations to take into account. Among these considerations is whether you need a will or a trust. A simple will is a short document that states to whom your assets will be distributed when you pass. Trusts also state to whom your assets will be distributed, but include additional features that allow you to further control the manner in which your assets are distributed.

The following explores the differences between a will and a trust as they may apply to you.

Simple Wills

A simple will is a short and simple estate-planning document that states to whom your assets will be distributed upon your passing. Your will names the person you wish to administer your estate, known as a personal representative or executor. For example, you may provide in your will that all of your assets will go to your spouse, and if he or she is not living, then equally to your children.

While a will has the benefit of being simple and effective in distributing your assets, it also has some limitations. Once you pass, your assets are distributed to your beneficiaries all at once. This means that you cannot substantially control when your beneficiaries will receive their distributions.

Typically, a will is also subject to probate. Probate is the legal process for administering an estate. It requires that your personal representative file papers with the court to obtain permission to administer your estate and make distributions to your beneficiaries.

Trusts

A trust is more complex and gives you additional control over the distribution of your assets. A trust states to whom your assets will be distributed and names the person you wish to manage your trust. This person is known as a trustee.

Additionally, trusts may include “strings attached,” allowing you to control when your beneficiaries will receive your trust assets. For example, if you have a large estate, you may wish for the assets to be held for your children, giving your trustee the discretion to determine when and for what purposes to distribute the trust assets to your children.

Trusts like that also provide the benefit of creditor protection for those children. This means that if your assets are held in trust by an independent trustee, your beneficiaries’ creditors cannot go after the trust’s assets. For this reason, in the event of your child’s divorce, the trust appreciation is more likely to be considered a separate asset rather than a marital asset.

While a trust has the benefit of giving you more control over distributions, this benefit also creates some disadvantages. Trusts are longer and more complex documents and require additional costs and administration after you pass.

Living trust versus will with a testamentary trust

If you think you need a trust, then you may be asked to consider whether you want a living trust or a will with a testamentary trust. A living trust is a trust you create now and transfer all of your assets into during your lifetime. A living trust has all of the benefits and disadvantages discussed above and also allows your estate to avoid probate. However, in order to avoid probate, your trust must be fully funded before you pass. This requires that you re-title certain assets into the name of your living trust during your lifetime. For example, you may have to change the name on your savings account to the name of your living trust.

A will with a testamentary trust, on the other hand, is a will that contains a trust that becomes effective only upon your passing. A testamentary trust carries same benefits described above, like allowing “strings attached” and creditor protection for your beneficiaries, but it does not allow your estate to avoid probate.

Conclusion

Visiting an attorney in person, or utilizing an attorney site like iWillandTrust.com are the best ways to further decide which one is right for you and to create your estate plan (do not use non-attorney sites, like LegalZoom, RocketLawyer, Fabric, etc., as they merely populate forms without an attorney customizing them for you, resulting in forms that do not meet your specific needs). We hope this information helps you decide whether you need a will or a trust, and ultimately helps you take steps to completing your estate plan.

Shelley Thompson is a Shareholder at the law firm, Burns, Figa & Will, P.C. Shelley handles all aspects of Wills, Trusts, and Estate matters at the firm.

Shelley Thompson is a Shareholder at the law firm, Burns, Figa & Will, P.C. Shelley handles all aspects of Wills, Trusts, and Estate matters at the firm.

Laura Fodor is a law student at the University of Denver Sturm College of Law and a law clerk at the law firm, Burns, Figa & Will. P.C.

Laura Fodor is a law student at the University of Denver Sturm College of Law and a law clerk at the law firm, Burns, Figa & Will. P.C.