How to Understand Your Strategic Asset Allocation

Asset allocation is a delicate game ruled by proper investing strategies and maintaining careful risk management.

Dan Kieffer //February 22, 2023//

How to Understand Your Strategic Asset Allocation

Asset allocation is a delicate game ruled by proper investing strategies and maintaining careful risk management.

Dan Kieffer //February 22, 2023//

A strategic investment strategy backed by a comprehensive financial plan can provide comfort in a volatile market. Below, we explore how asset allocation should be customized to your goals and risk appetite.

READ: 4 Key Asset Allocation Strategies for 2023

Establishing Your Goals

One of the most important steps to building your asset allocation is to establish your goals, along with a timeline, with your financial team. You will likely have multiple goals that are top-of-mind when you begin discussing your asset allocation. Once outlined, you will need to prioritize these with your team and discuss your risk tolerance.

Understand Your Risk Tolerance

When determining your risk tolerance, your financial team generally seeks the least amount of assumed risk you need to achieve your goals within your stated time horizon.

The longer your time horizon, the lower the risk associated with holding stocks. In the chart above, you can see that as you extend the holding period of the S&P 500, the annualized returns become less volatile. By the time you reach 15-year holding periods, it’s a reasonably flat line.

The statistics play out in the table below:

As you extend your holding period, the extreme results begin to mute, with the best and worst results becoming less extreme. Additionally, the batting average (the percentage of positive returns) increases. By the time you’re at an average 15-year holding period (see chart), you have only lost money 3.7% of the time, most of which occurred during the depression.

Another important distinction is your ability to take risks. Those who have established a larger base of investable assets will likely have more options than someone who is just beginning their investing journey.

READ: Choose Your Own Adventure: What’s Your Investment Path?

Your risk tolerance may change as you journey through life. Make this discussion a part of your regular financial review so you can adjust items as needed.

(Note: All investments involve risk, including the possible loss of principal. Past performance is no guarantee of future results.)

Customizing Your Asset Allocation

Now that you’ve established your goals, timeline and risk tolerance, it’s time to build your asset allocation.

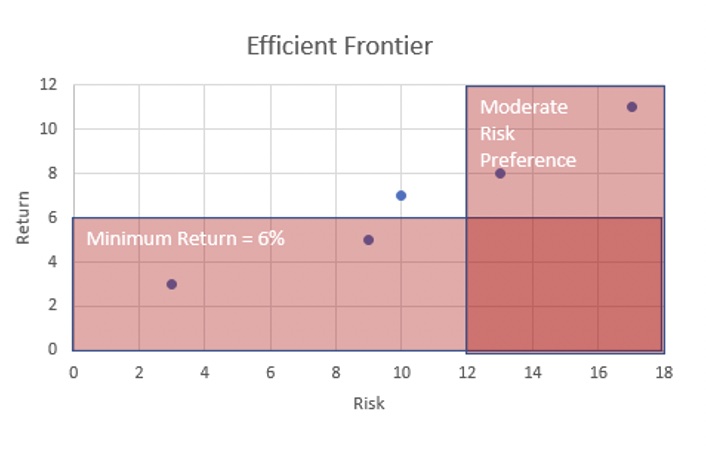

This graph represents possible portfolios available in terms of annual return as well as risk (or variation) around that average annual return. For example, if your team establishes that your goals require a 6% average return, you can set a lower bound that excludes portfolios that won’t meet your goals.

If, during the profiling process, your team establishes that you can’t take on more than 12% annual volatility, this creates another constraint that limits portfolio choices. Your team would then find that there is a single portfolio in the unshaded area that will both meet your return goals as well as stay within your risk parameters. This is how financial planning and preference profiling interact to allow your advisors to deliver a customized solution.

Your strategic asset allocation should include a blend of asset classes that reflects your risk tolerance and the timeline given to achieve your goals. Following are a few of the most used:

Stocks (S&P 500 and private equity)

Stocks are often the highest return and highest risk asset class, depending on the time period. They will generally be the driver of growth over time and have sensitivities to economic cycles and geopolitical events.

Bonds

Bonds are debt instruments (IOUs) issued by companies, governments and sometimes special purpose vehicles. They generally provide a stable income stream with a return of principal. Depending upon the credit rating of the issuing entity, the interest rate paid to investors varies—the greater the risk the greater the return.

Real Assets

Real assets are investments in real estate, infrastructure and natural resources, but can generally be thought of as items you can “touch.” Depending upon the particular investment, real assets generally provide inflation protection and/or a growing income stream.

Alternative Investments

Alternatives don’t neatly fit anywhere else, but can include items like:

- Managed futures, which attempt to profit from the trends that appear in asset prices.

- Insurance-linked securities, which provide profits like that of an insurance company’s balance sheet.

- Litigation finance, which provides profits from large class action lawsuits.

Private Investments

These include items like private equity and credit, real estate, natural resources, infrastructure and hedge funds. While only available to those with substantial resources (individuals with more than $5 million in net worth and organizations with more than $25 million in assets), they can provide an additional return above and beyond the liquid versions of each of the aforementioned asset classes.

Going through these asset allocation details with your financial team will ensure a higher level of understanding as your investments are selected and put to work for you.

Daniel (Dan) Kieffer is director of asset allocation of UMB’s family office services. He joined UMB in 2022 and has nearly two decades of financial industry experience. He earned his Master of Science in Finance from University of Cincinnati and is a Chartered Alternative Investment Analyst®. For more information on UMB’s asset allocation approach, email [email protected], or visit our website.

Daniel (Dan) Kieffer is director of asset allocation of UMB’s family office services. He joined UMB in 2022 and has nearly two decades of financial industry experience. He earned his Master of Science in Finance from University of Cincinnati and is a Chartered Alternative Investment Analyst®. For more information on UMB’s asset allocation approach, email [email protected], or visit our website.