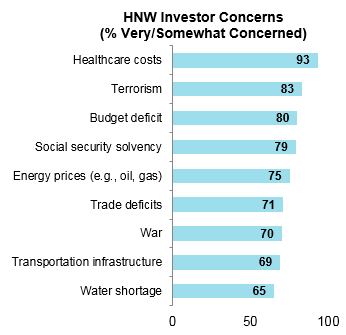

Here are the top nine concerns of Denver investors

The list includes health care costs, deficits, war and water

Stephen Stribling //October 15, 2015//

Here are the top nine concerns of Denver investors

The list includes health care costs, deficits, war and water

Stephen Stribling //October 15, 2015//

(Editor's note: This is the last of four parts. Read Denver investors: Interest rates going up; Denver investors' favorites for 2016; and Denver Investors: US is best .)

The issue of water shortage may eventually become larger than oil, according to the latest Morgan Stanley Investor Pulse Poll. Most Denver high net worth (HNW) investors feel that water shortages will become more of a problem over the next 10 years, and 54 percent believe that water has the potential to be a bigger international issue than the demand for oil.

The poll surveyed 1,003 HNW investors across the United States, including 300 from Denver. Individuals who are considered HNW investors have $100,000 or more in investable household financial assets, excluding real estate holdings and retirement accounts.

Interestingly enough, water shortages rank last as an issue HNW investors are concerned about (out of nine issues surveyed). One in four (24 percent) are “very concerned,” and just 12 percent of those who express at least some concern about water shortages select this issue as the one they are most concerned about.

However, when asked about America’s water supply, a large majority of HNW investors feel that either the same amount of regulation (47 percent) or greater (28 percent) is needed. One in four (25 percent) feel less regulation is needed.

Just over half (54 percent) say they have been affected by these shortages “a little.” Thinking specifically about HNW investors’ local areas, close to half (47 percent) are at least somewhat concerned about the potential for a water shortage. Even more (66 percent) expect their area is likely to be affected by water shortages in the next 10 years.

Many also predict that water shortages will lead to about the same number of international conflicts (64 percent) or more such conflicts (33 percent).

Not surprising given the water shortages and conservation efforts California residents have endured in recent months, concern about water in the two California markets surveyed is quite high. Although not quite at the levels recorded in the Los Angeles and San Francisco areas, Denver-area HNW investors stand out from HNW investors overall on several measures: saying that their daily life has been affected “a lot” or “a little” (60 percent vs. 47 percent), being at least somewhat concerned about water shortages occurring in their area (47 percent vs. 33 percent) and believing that water shortages are at least somewhat likely to strike their area in the next 10 years (66 percent vs. 33 percent).

Not surprising given the water shortages and conservation efforts California residents have endured in recent months, concern about water in the two California markets surveyed is quite high. Although not quite at the levels recorded in the Los Angeles and San Francisco areas, Denver-area HNW investors stand out from HNW investors overall on several measures: saying that their daily life has been affected “a lot” or “a little” (60 percent vs. 47 percent), being at least somewhat concerned about water shortages occurring in their area (47 percent vs. 33 percent) and believing that water shortages are at least somewhat likely to strike their area in the next 10 years (66 percent vs. 33 percent).

For Many, Concern Over Water Shortages Not Translating to Portfolios

Nearly nine in 10 (86 percent) say that US water shortages have not, to their knowledge, affected their portfolio. Still, a sizable one in four (26 percent) Denver-area HNW investors have either invested water-based conservation funds, or plan to do so in the next there years. Another 24 percent say the same of climate change funds.

One in 10 (11 percent) HNW investors plan to add investments that include water infrastructure or treatment to their portfolios in the next three years; 38 percent are unsure.

Moreover, interest in specific water-related investments is moderate, ranging from a high of 50 percent at least somewhat interested in investing in water re-use or treatment, to a relative low interest of 30 percent in water bond investments.

Most Do Not See Investment Potential in Legalized Marijuana; Oil and Gas Most Favored Energy Investment

Interest in investing in legalized marijuana is relatively low among Denver-area HNW investors. In the short term, seven in 10 (69 percent) are not at all likely to invest in the next 12 months; another one in five (17 percent) are not too likely.

When it comes to the energy sector, oil and gas investments prove most popular, with 45 percent currently owning them. Alternative energy investments rank in second place for current ownership (25 percent), though they take the lead in both considering (8 percent) and planning to invest in the next three years (12 percent). There is comparatively less interest in state-based energy companies and coal.

With all kinds of socio-political pressures affecting the economy, investors should be even more vigilant in reviewing and adjusting their asset allocation. Consider speaking with your financial advisor to ensure your overall portfolio strategy is right where it should be.