Rethinking operating reserves

Operating reserves are a unique component of organizational finance

Richard Todd & Natalie Roderick //May 31, 2021//

Rethinking operating reserves

Operating reserves are a unique component of organizational finance

Richard Todd & Natalie Roderick //May 31, 2021//

Operating reserves are a unique component of organizational finance. Among a variety of factors to consider are how–and how predictably–such funds are put to work, the asset liquidity necessary to make them available when needed, and the inflows and outflows occurring within those reserves.

Continued low interest rates have further driven investment committees and finance executives to rethink how they manage operating reserves.

Objectives for these assets can vary for an organization, ranging from a very short-term time frame to a non-specific objective or investment horizon.

Non-profit organizations have additional considerations, not least of which is the benefit derived from their tax-advantaged status and the flexibility to manage assets in a tax-exempt, quasi-endowment approach.

For all organizations, there can also be a variety of experience levels in the financial suite managing these funds.

Here’s a recommended approach in managing operating reserves to drive better results in the current environment.

A Few Concepts to Consider

The longer the time frame, the more predictive return expectations will be. Hence, most endowment like assets have high equity exposure. In examining the last 75 rallying 10-year calendar periods exhibited by the S&P 500, 73 have been positive, the exceptions being 1999 to 2008 and 2000 to 2009. Therefore, the longer the time frame, the more equity exposure a portfolio should have.

Valuation should be considered in evaluating and setting equity return expectations. The chart below depicts the forward 5-year historical returns based on the valuation at the beginning of the period. Stocks are not cheap (inexpensive) today.

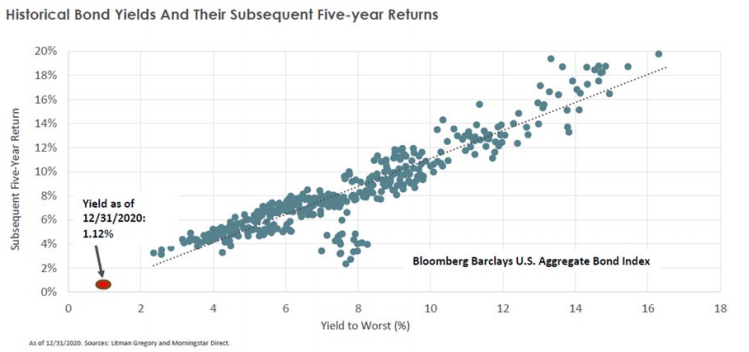

Bonds have been the predominant investment of choice for operating cash. Historical bond returns can be highly misleading in portfolio construction. Future bond results are anchored to the current yield.

No predictor is perfect, but as the chart below illustrates, abnormally low rates found in the current environment forecast future bond market returns that will be very low, as compared to history.

Quantify Downside Risk

We strongly urge that the downside risk of portfolios with different objectives be quantified. Our forward view of the capital markets seeks to quantify a “worst case” drop in a portfolio over a forward-looking 1-year time frame.

We calculate both a one-in-twenty chance (95% percentile) and a one-in-one-hundred chance (99% percentile) of a one-year loss.

Thinking this way helps “worst case scenario” planning, an important factor in designing a portfolio. It also keeps a committee or executive grounded in difficult markets, where mistakes are often made. “Staying the course” is made easier.

Importantly, it is imperative that rebalancing of portfolios in these markets should still occur. Our mantra at Innovest is “process over prediction.”

As observed in March of 2020, countless prognosticators came out of the woodwork with over-confident assertions as to what the near- and long-term markets would do, often with impulsive actions recommended to be taken in response.

Most were very wrong, to the detriment of investors that heeded the predictions. A prudent process standard that includes rebalancing is not only fiduciarily sound but leads to sustained investment success.

Case Study – Midsized University

One higher education client we support has been very successful in fundraising for capital projects around their campus. These projects have been in various stages, from planning to implementation, but historically their portfolio did not reflect the different time horizons associated with each.

- Through dialogue and understanding of the various goals of their portfolio, we were able to design a custom approach, with a recommendation to divide the portfolio into four buckets: Short-term (1-3 years)

- Mid-term (3-5 years)

- Long-term (5 years +) and design a custom allocation for each investment goal

- Very long-term (10 years +) or endowment/foundation

An important consideration was that the portfolio risk of each “bucket” was reduced as the time frame shortened. While portfolio returns were targeted, they were not considered bullet payments, as with a bond. As a result, the earnings on their overall portfolio have grown dramatically.

Implementation

Investment products for implementation should be customized to the unique circumstances of the organization. For taxable portfolios, index funds can work well and are very tax-efficient and inexpensive.

Active management in areas like hedge investments, floating rate loans, and fixed income are recommended. No matter the circumstances, proper due diligence by an unconflicted, experienced investment consultant is vital.

Process is a key fiduciary standard and important in managing reserve assets. It is considered best practice for an advisor to be a co-fiduciary with their clients to ensure that all parties interests are aligned.

We are confident that a thoughtful approach to managing operating reserves has a higher likelihood to outperform a simple bond portfolio in the current interest rate environment.

Richard Todd, Innovest CEO, Co-Founder & Principal Rich is the CEO and Co-Founder of Innovest Portfolio Solutions. He has more than 30 years of experience in investment consulting and currently provides consulting services to both institutions and families. Rich was selected a 2017 outstanding CEO by ColoradoBiz magazine. Rich has a business finance degree from Western Colorado University.

Natalie Roderick, Innovest Vice President As a Vice President at Innovest, Natalie is responsible for business development in the nonprofit, education, and healthcare markets. She works collaboratively with the Innovest team to develop and lead industry specific conferences and solutions for her clients. With over 25 years of experience in marketing and business development, as well as owning a small business for 12 years, Natalie understands the importance of surrounding yourself with people you can trust.