Global SaaS company Ansarada is focusing its attention on Colorado, with two in-depth reports on private market trends and M&A predictions for the Centennial State.

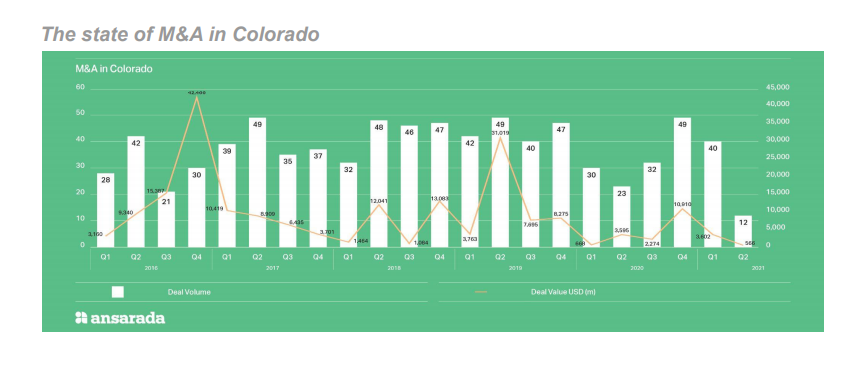

New data reports conducted by Ansarada with Pitchbook and Mergermarket, the Colorado market has shown impressive levels of corporate activity and innovation. Colorado’s private markets have roughly doubled in size over the past decade. The pandemic is expected to further fuel innovation and deal activity, which will accelerate the growth of the region’s high-tech sector and startup scene.

“Compared to other states, Colorado has many unique opportunities in the healthcare and technology sectors. The target pool is better and includes higher-quality companies overall,” says the managing director of an investment bank.

“Colorado has a strong track record of producing great returns for investors. It has healthy industrials and energy sectors, and one of the most vibrant tech ecosystems,” says Sam Riley, CEO of Ansarada. “Also, we are seeing a trend of people discover during COVID that they can work from wherever they want. This benefits cities, Denver among them, where you can get more bang for your buck with housing, as well as a vibrant city life, surrounded by some of the best nature in the world.”

The data shows Colorado is in an enviable position, poised for strong M&A and investment activity in coming months.

Private Equity and Venture Capital Trends

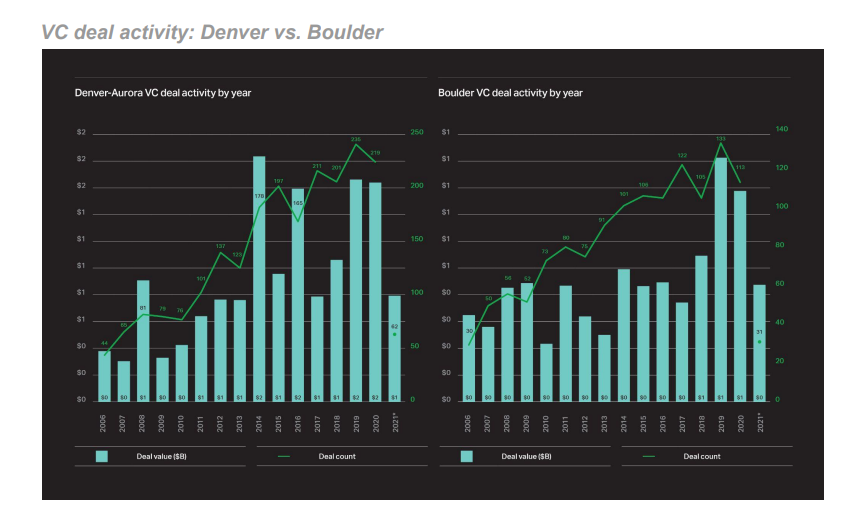

Researched in conjunction with PitchBook, Ansarada’s Spotlight on Colorado’s private market ecosystem report shows growth and dynamism across the VC, PE, and M&A markets. Colorado’s VC ecosystem is roughly twice as big today as it was a decade ago.

With more than three dozen charts across VC, PE, M&A, and exit activity, this report provides a comprehensive snapshot of Colorado’s private markets. Much of the data points to impressive-but-sustainable growth in dealmaking, as well as resilience in the face of COVID-19.

Coloradan Dealmakers’ M&A Predictions

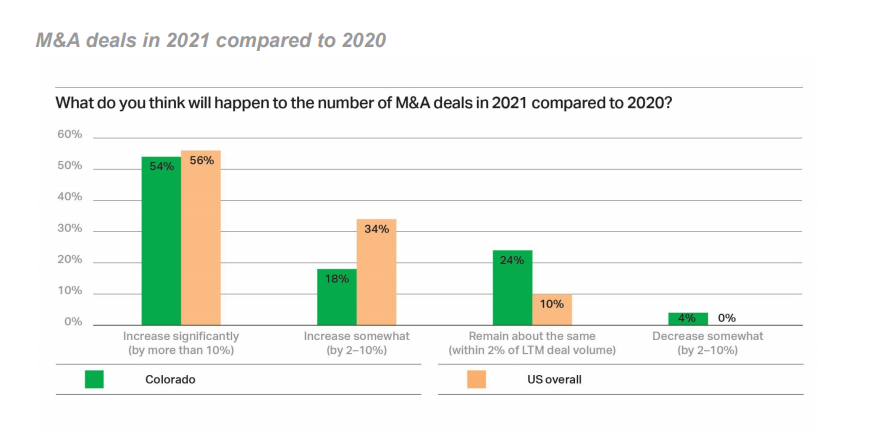

Unsurprisingly, deal executives are positive about the outlook for M&A in Colorado. A 72% majority foresee an uptrend in transactions in 2021, with investment into the technology sector predicted to rise. A recovery for the energy, mining and utilities market is also likely to benefit Colorado.

Ansarada has partnered with Mergermarket to deliver the Moving Mountains: 50 Coloradan Dealmakers’ Predictions, a survey of 50 senior executives to gain insights into how financial sponsors and corporates view this bustling region and its M&A prospects.

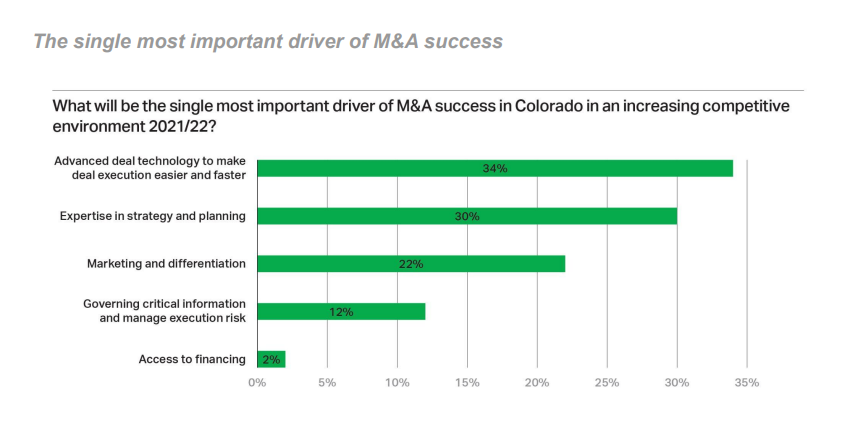

Deal technology & digital tools fuel growth

The pandemic has driven home the value of data. The smartest advisors and investors recognize that access to data and applying advanced analytics can mean the difference between winning or losing their next deal, or–potentially worse–overbidding for assets. Technological tools are what will distinguish the best dealmakers from the rest.

Just as Colorado is proving itself to be a serious contender in the innovation stakes, so too can investors in the state become some of the most advanced in applying technology and digitization to their dealmaking efforts and activities.

Ansarada is a fast-growth, global tech company on a mission to give advisors and companies confidence for their biggest moments, including capital raises, IPOs, M&A deals and more. Since 2005, more than 23,000 transactions have been run through the market-leading Ansarada Data Room.