If you suddenly inherited $1 million, with the only stipulation being that it had to be invested in the stock market, would you invest it all by nightfall or invest some now and gradually invest the rest over time? Would your answer be different if the windfall were only $1,000 instead of $1 million?

Simple logic, probability, and empirical evidence all dictate that the better choice is always to invest the entire amount immediately, as we will explain.

Many people answer the second question differently because of the amounts involved. This is, of course, logically inconsistent, and we will explain the behavioral psychology underlying such erroneous thinking.

Logical proof: Immediate investment enjoys upward trend for longer time

From 1926 to 2019, the S&P 500 index had a total positive return in 69 out of 94 years, or 73% of the time. The average annual total return has been about 10%.

The expected return on an asset class represents the sum of the current risk-free rate (i.e., inflation plus the 30-day Treasury bill rate) and one or more historical risk premiums as compensation for each element of risk. Historically, and based on an average risk-free rate of about 3.5% (consisting of 3% inflation plus a 0.5% premium for cash), the risk premium for large-cap equities has been about 6.5%.

To withhold money from immediate investment in equities is to implicitly assume that there is no premium return available from the asset class over the long term. This is wrong. One may debate the amount of premium available at any particular moment given the valuation of equities, but a premium must always exist to induce investors to own risky assets such as stocks and bonds. Therefore, as long as one assumes equities will continue to provide a positive risk premium above cash, investing immediately must provide better portfolio returns on average than holding cash.

Empirical proof: Stock market returns after all-time highs and 10% declines

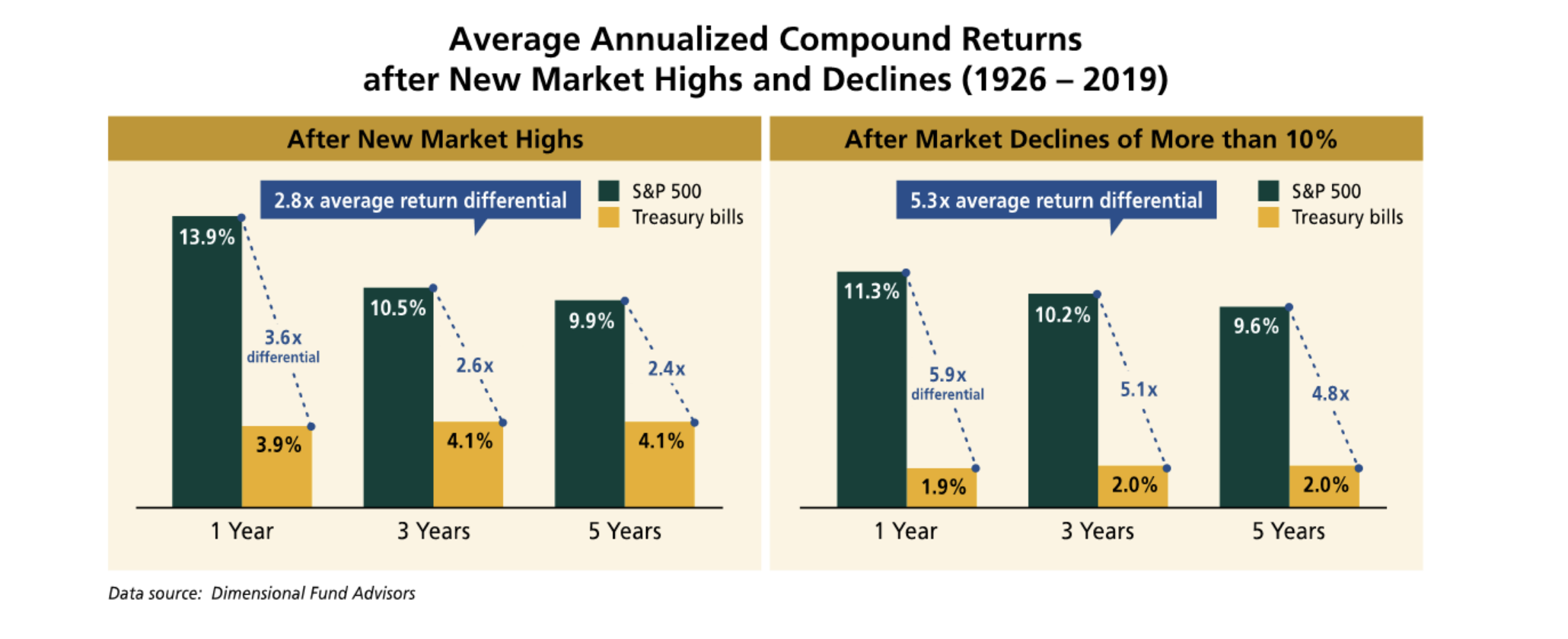

The charts below show the average annualized compound returns of the S&P 500 from 1926 to 2019 compared to 1-month Treasury bills in two different scenarios.

The chart on the left measures the returns over different time periods after the index had hit all-time highs. For each time period, the returns are positive and in line with historic equity returns. After the market hit a new all-time high, on average, it returned 2.8x more than the alternative of being in cash.

The chart on the right shows returns after a decline of more than 10%. The S&P 500 returns over the different time periods once again all clock in at about the historic average of 10%. However, because the average subsequent Treasury returns are about 2%, the average equity-to-cash return differential is a whopping 5.3x.

Conclusion: The data do not support the notion that recent market performance should influence the timing of stock investments.

Why market timing doesn’t pay

Based on annual returns, the equity market is up far more often than it is down—about 75% of the time. This means the chance the market will rise in any given year after you invest is 3 to 1 in your favor. Conversely, the chance that it will fall in the ensuing year is only 1 in 4. So the longer you wait to invest in equities, the more likely you are to miss out on opportunities for your money to enjoy the associated premium return.

Countless studies quantify the powerful concept that investor returns from equities are ultimately determined by the amount of time in the market, demonstrating that trying to time the market is a fool’s errand.

Regret and loss aversion

Psychological research and behavioral evidence have demonstrated that humans are “loss-averse.” That is, we typically regret losses at least twice as much as we appreciate similar-sized gains.

Because the chance of experiencing negative returns is higher in the short term, the more frequently investors evaluate their portfolios, the more likely they are to see losses and develop loss aversion. By the same token, the less frequently they evaluate their portfolios, the more likely they are to see gains.

Minimizing potential for regret

Although research and history clearly show that immediate lump-sum investments consistently outperform a dollar-cost averaging approach over time1, many people choose some variation of the second option, and the long odds against it, because they fear the potential downside of a sudden drop in portfolio value associated with an immediate investment. From that perspective, the primary benefit of spreading out the investment is to minimize regret.

Unfortunately, when fear wins out over logic—as it often does—people attempt to reduce the chances of regretting their decisions by investing windfalls slowly over time. Ironically, if these same people were to subsequently compare the results of investing right away versus spreading out their investment, they’d surely regret the money they didn’t make by delaying.

So no matter what happens in the markets, the economy, politics or the world, remember that in the long term, you’ll be better off investing that lump sum by nightfall, whether it’s $1,000 or $1 million.

Behavioral takeaway

Although loss aversion is part of our psychological wiring as human beings, the frequency of evaluations is a choice that investors (and their investment advisers) can control. And since most investors are accumulating assets in preparation for a multi-decade retirement—or longer, in the case of planned trans-generational wealth transfers—it makes sense to adopt evaluation periods corresponding with these time horizons. When you have a lump sum to invest, act by nightfall and put it to work immediately. Then, once it’s invested, think in decades, not days.