The Unintended Consequences of Beer in Colorado Grocery Stores

Starting Jan. 1, 2019, full-strength beer will be available in average markets – What's the impact on real estate?

Glen Weinberg //December 21, 2018//

The Unintended Consequences of Beer in Colorado Grocery Stores

Starting Jan. 1, 2019, full-strength beer will be available in average markets – What's the impact on real estate?

Glen Weinberg //December 21, 2018//

In almost every other state in the union, you can walk into a grocery and buy full-strength beer or wine – but not Colorado.

That is, until January 1.

Why the change and what is the impact on real estate?

I was surprised to see the passing of Senate Bill 243 in the waning days of the last legislative session. It seemed oddly out of place that Gov. John Hickenlooper, a former brewpub owner, quietly signed the bill without a single witness to the event. This bill radically changes where and how suds can be sold throughout the state. This bill will change consumer choices and have profound impacts on grocery-anchored retail. Will a percentage of stores close due to this change?

HOW DOES LIQUOR LAW WORK IN COLORADO?

The sale of beer, wine and spirits is unique, particularly if compared to the rest of the country. Liquor stores are the only establishments able to sell with one exception: There was a provision that allowed groceries one location in the state.

Grocery stores could only sell low-strength beer – 3.2 percent alcohol by volume – which very few people actually purchased.

Liquor stores had a monopoly on the sale of beer, wine and spirits.

WHAT IS SENATE BILL 243?

Hickenlooper signed Senate Bill – an update to SB 197 in 2016 – into law, effective Jan. 1. The primary provisions of the bill include:

- Allow grocery stores that currently sell 3.2 beer to sell full-strength beer.

- Allow employees 18 years and older to sell beer.

- Expand the number of grocery locations permitted to sell beer, wine and liquor from one to 20 over the next 20 years.

WHY DOES IT MATTER?

Currently, next to almost every grocery store in the state, there is a liquor store. This isn't an accident. Many consumers buy groceries and then go next door to buy a case of beer. This will no longer occur as consumers will likely just buy the case when they are picking up other grocery items. This will drastically impact the profitability of those liquor stores.

Furthermore, stores like King Soopers will be able to buy product considerably cheaper than a single liquor store, purely based on volume. For instance, there is one Costco in the state – on Wadsworth – that also sells beer, wine and liqour. Their prices on beer are between 15 percent and 20 percent cheaper than liquor stores. Large markets will be able to price substantially lower than the liquor store.

MANY LIQUOR STORES WILL GO UNDER

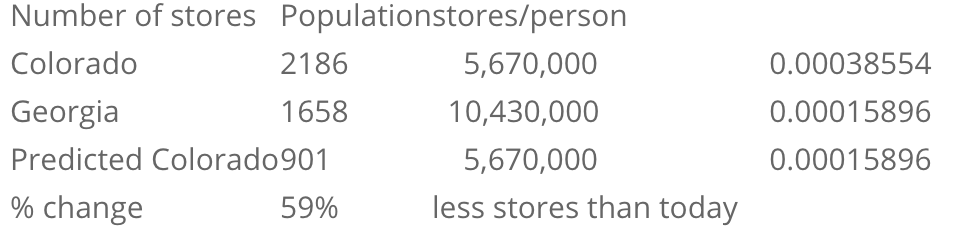

There is only a finite demand for beer, wine and spirits. As more consumers purchase beer from traditional grocery retailers, it will be challenging for many liquor stores to stay in business. The question is how many liquor stores will close? I did a quick analysis of liquor stores per person to see how Colorado stacked up against other states. I chose Georgia as a baseline, as in Georgia you can buy beer and wine in grocery stores, but to buy liquor, you would need to go to an actual liquor store. This is essentially the model that Colorado is transitioning to.

WHY COLORADO REIGNS AS THE NAPA VALLEY OF BEER

I looked at total liquor stores per population in Georgia and Colorado. Georgia has double the population of Colorado, yet Colorado has more liquor stores. With the recent change in Colorado liquor laws, Colorado should look more like Georgia regarding liquor stores per population.

Based on Georgia's number of liquor stores per person, this will lead to a decline of almost 60 percent of all liquor stores in Colorado.

IMPACT ON REAL ESTATE

Grocery-anchored retail throughout Colorado will be under increasing pressure. According to Costar – the largest commercial real estate data provider:

"Because many developers and landlords still consider the grocery anchored sector to be a safe defensive play against e-commerce that brings foot traffic, we are continuing to see more absorption and development that could perhaps lead to issues with oversupply," McCullough said.

"While total retail space per capita has decreased by about 5 percent since 2009, the amount of anchored space per capita has increased by the same amount during that period amid competition from big-box chains that have added food and groceries to compete with grocery chains."

With almost 1,200 liquor stores likely closing over the next several years substantial grocery anchored retail space will be available. At the same time, substantial inventory of new centers is coming online and natural attrition from e-commerce is also occurring. Who will fill all this vacant space that doesn't already have a presence in these same centers? In Colorado, grocery-anchored retail will be challenging with the increase in supply and limited new demand.

The national economy is already showing signs of cooling off, the increased closing of a substantial number of liquor stores will put downward pressure on retail rents and prices throughout Colorado. On the flip-side, at least it will be less expensive and more convenient to buy beer which might be necessary if you are a large owner of grocery-anchored real estate.