With Cannabis Banking On the Horizon, Real Estate Value Plummets

The effect of cannabis banking on real estate

Glen Weinberg //October 29, 2019//

With Cannabis Banking On the Horizon, Real Estate Value Plummets

The effect of cannabis banking on real estate

Glen Weinberg //October 29, 2019//

The House of Representatives passed a bill with bipartisan support that would allow banks to provide services to cannabis companies in states where it is legal. What was in the bill? How will this impact real estate throughout the country? Before you pop the magic muffin in celebration, there are still a couple major hurdles before cannabis banking becomes law.

Why should you care about cannabis banking?

With cannabis legal (in some form) in 33 states, the amount of cash being used is astounding. It doesn’t matter what your political affiliation is or whether you support or don't support legal marijuana, it all boils down to dollars and common sense. I’ve seen tax predictions in Colorado ranging from $100 million to $184 million in tax revenue. And currently, the industry operates in cash with little access to mainstream banking.

I would be willing to bet a million bucks that not all the revenue is being reported in a cash business. For example, how many waiters/waitresses, or other workers who get paid in cash, report all of their tip income? The heavy reliance on cash in the cannabis industry enables less scrupulous activity (money laundering, drug cartels, etc…). In any industry, forcing legitimate businesses into the cash arena is bad public policy.

What is in the proposed house bill?

The bill clarifies that proceeds from legitimate cannabis businesses would not be considered illegal, and it directs federal regulators to create rules for how they would supervise such banking activity.

Banks have thrown their weight behind the legislation, telling lawmakers they need clarity on whether they can do business with cannabis companies where it is legal at the state level, even though marijuana remains illegal in the eyes of the federal government.

“Our members are committed to serving the financial needs of their communities – including those that have voted to legalize cannabis,” says the American Bankers Association in a letter sent to lawmakers seeking their support.

What is the impact on real estate if the cannabis banking bill passed?

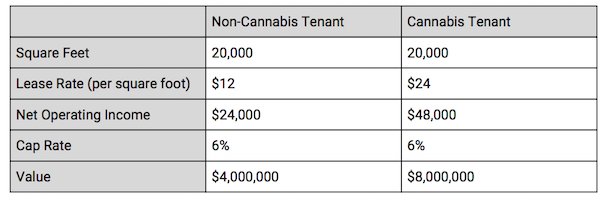

Currently cannabis operates in a legal gray area with legalization at the state level, but not the federal level. This ambiguity has made legal cannabis operations very difficult to finance. For example, a bank will not make a loan on a property with a cannabis tenant. As a result, rents and prices for cannabis properties are well above market to price in the lack of traditional funding. A property owner will demand a premium for a cannabis tenant versus a non cannabis tenant due to the lack of financing available.

As banking becomes established for the cannabis industry either through this bill or a subsequent bill, real estate prices will also come into line. The premium for a cannabis lease will be eliminated, leading to drastic reductions in the value of cannabis real estate. For example, in Denver, cannabis space is going for about double what a traditional tenant would pay. With cannabis banking on the horizon, this premium paid by cannabis tenants will be eliminated. As you can see below, the value of the industrial building dropped by almost $4 million due to the steep reduction in lease rates. Remember that commercial property is valued based on the income it will produce, divided by the desired rate of return (capitalization rate).

Will the bill pass the senate?

Unfortunately, in the current senate session, I am doubtful the bill will pass. There are several competing priorities, along with an upcoming election cycle that will likely force the house bill onto the back burner. It will likely be a few more years before there is federal legislation to enable cannabis banking.

Summary

Although cannabis banking at the federal level will likely not be resolved this year, with 33 states involved in some form of cannabis (either recreational or medical), it is only a matter of time before the banking issues are addressed. I would suspect after this election cycle, to see this issue resurface with a resolution. It is important to note that when the banking is solved, there will a quick "adjustment real estate prices in this industry as it comes into line with more traditional industries.