Rebalancing for the long run

Bruce Hemmings //January 9, 2014//

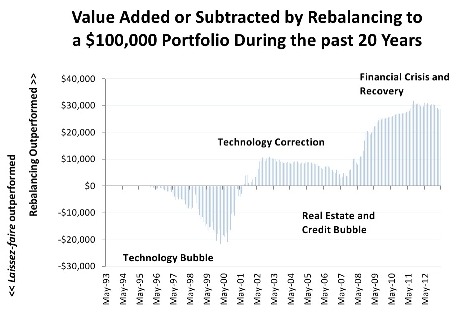

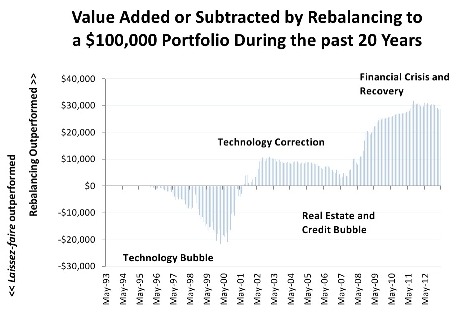

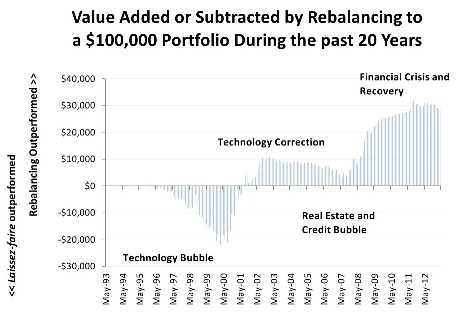

Portfolio balancing may seem like a statistical exercise. But over the past 20 years, investors who made sure their portfolio allocations remained close to target could have fared better than those who took a laissez-faire approach.

Consider the results for two hypothetical portfolios allocated 60 percent to stocks and 40 percent to bonds on May 1, 1993, and set to mirror the performance of the S&P 500 (stocks) and the Barclays Aggregate (bonds). One of the hypothetical portfolios would have been rebalanced to 60/40 every time either asset class grew more than five percentage points above its target. The other portfolio would have had its allocations left unaltered regardless of market changes.

At the end of April 2013, the rebalanced hypothetical reference portfolio would have produced stronger annualized returns (8.22 percent vs. 7.86 percent) and less volatility (a standard deviation of 9.24 percent vs. 10.63 percent).*

This chart illustrates the potential performance benefits of a rebalanced portfolio compared with a laissez-faire portfolio. It suggests that the benefits of rebalancing may be most apparent during times of significant market volatility and uncertainty. Each column in the chart represents the hypothetical difference in cumulative month-end net asset value between rebalanced and laissez-faire reference portfolios.

Both hypothetical portfolios were initially valued at $100,000 and allocated 60 percent to stocks mirroring the total return of the S&P 500 and 40 percent to bonds mirroring the total return of the Barclays Aggregate bond index. The rebalanced portfolio was brought back to a 60 percent/40 percent allocation each month one of the asset classes exceeded its target allocation by five percentage points.*

Considerations for Creating a Rebalancing Program:

• Establish a baseline asset allocation. As your Financial Advisor, I can help you determine the optimal equity/fixed-income balance for expressing your investment goals and risk tolerance.

• Create an allocation monitoring program. Some investors monitor their portfolios daily or weekly; others prefer only monthly or yearly reviews. Portfolios with exceptionally volatile holdings should generally be monitored more closely; investors with relatively less tolerance for risk may also want more active monitoring.

• Consider the costs and benefits of different rebalancing strategies. Rebalancing activities have costs, including transaction expenses, trading costs and commissions. You may be able to manage those costs by refocusing your new investments only, rather than selling existing holdings to finance a change. In the same vein, you should set a rebalancing threshold that’s high enough to help you avoid excessive trading while still helping to limit your exposure to portfolio volatility.

• Set a sell discipline. Choosing what to sell and when to sell it can be just as important as your initial commitments. Investors should consider past and future performance potential and the tax consequences of a sale before choosing particular assets to be sacrificed for rebalancing.

Portfolio rebalancing can be an important component of investment management. It is also a complex endeavor with many types of considerations to weigh.

Sources/Disclaimers

*Sources: S&P Capital IQ; Barclays. Calculations based on month-end total return indexes covering the 20-year period ended April 30, 2013. Past performance does not assure future results. Investors cannot invest directly in any index. Index performance does not include any of the fees, commissions and taxes that might be incurred by actual investments. Asset allocation and rebalancing do not assure a profit or protect against a loss. There may be a potential tax implication when rebalancing. Please consult your tax advisor before implementing such a strategy.