Sequester deal in sight?

Bart Taylor //February 13, 2013//

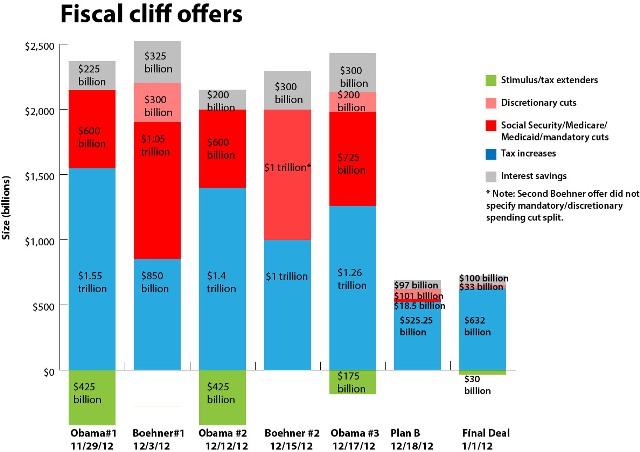

Early this year, after agreement on the fiscal ‘cliff’ deal was reached, the Washington Post published this fascinating chart depicting the various proposals from Speaker of the House Boehner and President Obama.

While the chart likely won’t change minds, it may very well betray where a deal might be reached in the coming weeks.

President Obama’s last offer offer to Speaker Boehner called for a dollar-for-dollar deal – $1.3 trillion in cuts for about the same in new revenues, $1.26 trillion – the ‘grand bargain’-type agreement the White House sought. While not as fundamentally game-changing as Simpson-Bowles, this final shot to ‘go big’ would have been a more impactful debt-deal than what passed, and required each side to compromise significantly.

This week, the White House said the deal was still on the table, and I’m guessing the parties will come back to this framework and agree on roughly the same levels outlined in the dollar-for-dollar proposal. In exchange for about $1 trillion in spending cuts outlined in the President’s last offer, Republicans should be able to agree to half the $800 billion in revenue they already forecast would materialize through tax reform. The $400 billion would even-out total revenues (along with the $600 billion in the cliff-deal) with new spending cuts.

Deal.

It makes sense. It that its demise?