Survey says: Health care change is coming

Kathy Jacoby //November 24, 2014//

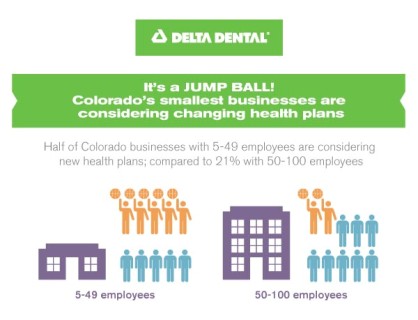

Half of Colorado’s smallest businesses are considering changing health insurance carriers for 2015, according to results of recent statewide survey of small businesses commissioned by Delta Dental of Colorado.

Half of Colorado’s smallest businesses are considering changing health insurance carriers for 2015, according to results of recent statewide survey of small businesses commissioned by Delta Dental of Colorado.

Among businesses with five to 49 employees, half are considering changing their insurance carrier next year, while the other half felt “extremely” or “very” confident that they would renew with their current carrier. Larger businesses with 50 to 100 employees are more likely to keep their current carriers, with seven in 10 saying they were “extremely” or “very likely” to stay with current plans.

The results are among the key findings of Delta Dental of Colorado’s 1st Annual Colorado Small Business Health Benefits Survey, a telephone survey of 320 small business owners and benefits decision-makers across Colorado conducted in August and September.

‘Jump Ball’ for Colorado’s Smallest Businesses

“Small business owners told us they are in a state of ‘jump ball’ when it comes to health benefits, and they are open to change,” said Kate Paul, CEO of Delta Dental of Colorado. “They are feeling the effects of the Affordable Care Act and see more change ahead. But despite the uncertainty, they value health benefits – including dental coverage – more than ever.”

Nearly nine in 10 Colorado small business owners and benefits decision-makers consider employee benefits “extremely” or “very” important, and a majority see benefits getting more important in the future as a way to attract and retain talent. Among ancillary benefits, dental insurance is the most popular option, with nearly eight in 10 businesses offering dental coverage.

Other findings of Delta Dental of Colorado’s 1st Annual Colorado Small Business Health Benefits Survey include:

- More than half of Colorado’s smallest businesses (under 50 employees) say the Affordable Care Act (ACA) has impacted their benefits offerings, with most citing increased cost.

- Nearly six in 10 small businesses expect more change in 2016.

- Seven in 10 small businesses say insurance brokers are more important because of the ACA.

- While awareness of the Small Business Health Options Program (SHOP, an ACA marketplace specifically for small employers with 50 or fewer employees) is low, a majority of small businesses would consider using it for their employee benefits 2016.

Knowledge Gap Remains

Knowledge Gap Remains

The research revealed a knowledge gap among Colorado small businesses, with only four in 10 feeling knowledgeable about the impact of the ACA on their businesses. Businesses outside the Denver Metro area reported feeling the least knowledgeable about the ACA.

“These findings reflect what our members are experiencing coming into Open Enrollment – change is happening and small businesses need help navigating the new health care landscape,” said Kelly Brough, president and CEO of the Denver Metro Chamber of Commerce and Board member of Delta Dental of Colorado. “This is critical information for all of us who serve small businesses on a daily basis. We must continue to engage owners and benefits decision-makers about the impact of the ACA on their businesses.”

When It Comes to Benefits, Size Matters

Delta Dental of Colorado’s 1st Annual Colorado Small Business Health Benefits Survey revealed several key differences among Colorado’s smallest businesses (under 50 employees) and their larger counterparts.

“When you are talking to Colorado small businesses about employee benefits, size really does matter,” said Karl Weiss, president of Colorado-based Market Perceptions & HealthCare Research, which conducted the research. “Among the smallest businesses with no dedicated human resources managers, owners are the most likely to feel uneducated about the ACA and open to changing the way they provide employee benefits, including moving to the SHOP. Larger businesses with dedicated HR managers tend to be more educated about the ACA and more confident in the benefits packages they have created, at least for now.”

For full survey results visit: http://www.deltadentalco.com/healthbenefitssurvey.aspx

(This sponsored content was provided by Delta Dental of Colorado.)

About Delta Dental of Colorado

Established in 1958, Delta Dental of Colorado is the largest, most experienced dental benefits company in the state. It is a nonprofit organization that serves nearly 1 million Coloradans with high-quality, cost-effective, evidence-based dental plans. Delta Dental of Colorado’s mission is to improve the oral health of the communities it serves. Delta Dental of Colorado is a member of the national Delta Dental Plans Association (DDPA). For more than 50 years, the DDPA has worked to improve oral health nationally. Delta Dental member companies serve more than 47 million people nationwide. www.DeltaDentalCO.com.

About Healthcare Research

HealthCare Research is a nationally-recognized research and evaluation firm, providing expert strategic analyses in a rapidly-changing health care environment. Clients benefit from a full range of research and evaluation services, including quantitative assessment (surveys, statistical modeling, text analytics, data mining), qualitative inquiry (focus groups, in-depth interviews, ethnography) and innovative decision support-making activities surrounding healthcare reform (EHR data analysis, meta-analysis, stakeholder engagement). Better Questions. Better Answers.™ www.healthcareresearch.com