Kristin Keffeler will help Johnson Financial Group incorporate a more holistic approach in helping clients achieve well-being beyond preserving and growing their wealth.

Johnson Financial Group takes an integrated approach in finding better ways to manage wealth, tackling the complexities that often come with investment and financial planning to finding the right advisor team. Based in Denver, the Group operates as a family office with more than 40 years in generational service.

In a recent progression, the firm has created the new position of ‘Chief Learning Officer’ and appointed longtime coach and consultant, Kristin Keffeler, in order to incorporate a more holistic approach in helping clients achieve a financial health of well-being beyond preserving and growing wealth.

“We believe that Kristin’s interactions with our clients will be truly transformational, giving the families we work with the opportunity to learn the best practices about communication, strength building and establishing a healthy legacy,” said Brandon Johnson, Principal and CEO of Johnson Financial Group.

Keffeler is a professional advisor who has spent more than 15 years guiding families on wealth and enterprise management, residing in a dual role as founder and coach of her consultancy, illumination360. She specializes in facilitating conversations about crucial subjects, and collaborates with families in identifying their values, principles that guide decision-making, and visions to realize success as individuals and as a group.

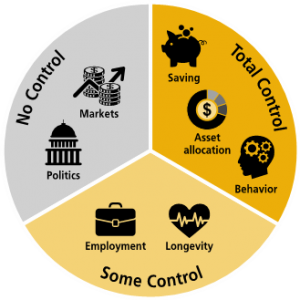

At Johnson Financial, Keffeler will lead the way in supporting clients to identify opportunities and challenges through their planning, while providing guidance on family governance, family dynamics, behavioral change, and intergenerational collaboration.

Keffeler holds a master’s degree in Applied Positive Psychology from the University of Pennsylvania, including a master’s degree in Business Management and undergraduate degree in Biology and Chemistry from the University of Denver.

A sought-after speaker, Keffeler has presented for the Financial Planning Association, the Denver Estate Planning Council, The Kinder Institute of Life Planning, and Resource Generation.

Keffeler serves as Dean of Psychology at the Purposeful Planning Institute, and is an advisory board member of the Bailey Program for Family Enterprise at the University of Denver’s Daniels College of Business.

Additionally, Keffeler has contributed toward the book, “Wealth of Wisdom: Top Practices for Wealthy Families and their Advisors,” and has written for Entrepreneur, Journal of Financial Planning, Trusts & Estates, Journal of Practical Estate Planning, and Denver Business Journal.

Her research on the traits and skills that guide intergenerational collaboration was recently published in 2018, “Becoming the Rising Generation: Uncovering the Path to Thriving for the Next Generation in Ultra-high Net Worth Families,” supporting a path for the next generations and their families to thrive.

“Kristin is a national thought leader in this space, and we’re thrilled to share her talents with our clients.” -Brandon Johnson, Principal and CEO of Johnson Financial Group

About Johnson Financial Group

Johnson Financial Group is one of the country’s most exclusive, integrated family offices, offering a unique understanding of the complexities and challenges facing affluent families. Through its wealth management arm, the firm provides advising, investment management, financial planning and private capital access. Johnson Financial Group’s history as a single-family office extends across 40 years and encompasses four generations.